CLAIM DASHBOARD

To File A Claim Please Report By Calling On Below Toll-Free Numbers!

Motor Insurance

| Company | Helpline No. | Company Claim Link |

|---|---|---|

|

18001032292 | Raise Claim |

|

18002700700 | Raise Claim |

|

1800225858 18001025858 |

Raise Claim |

|

18002585956 | Raise Claim |

|

18003009 | Raise Claim |

|

180030030000 | Raise Claim |

Health Insurance

| Company | Helpline No. | Company Claim Link |

|---|---|---|

|

18002700700 | Raise Claim |

|

18002004488 18605004488 |

Raise Claim |

Raise Claim Form

Claim Assistance

Claim settlement is one of the most important services that an insurance company provides you. Insurance companies are bound to settle the claims promptly. Every product has a different claim process which you might go through. You must know the process of claim before initiating with it. Here, we attempt to help you provide the information on the claim process. This will tell you what information you need before you get in touch with your insurance company and what you can expect from the claim process.

Health Claim Process

In today's lifestyle, one can face health issues anytime. Got the health insurance but not knowing what to do when need arise at that time?

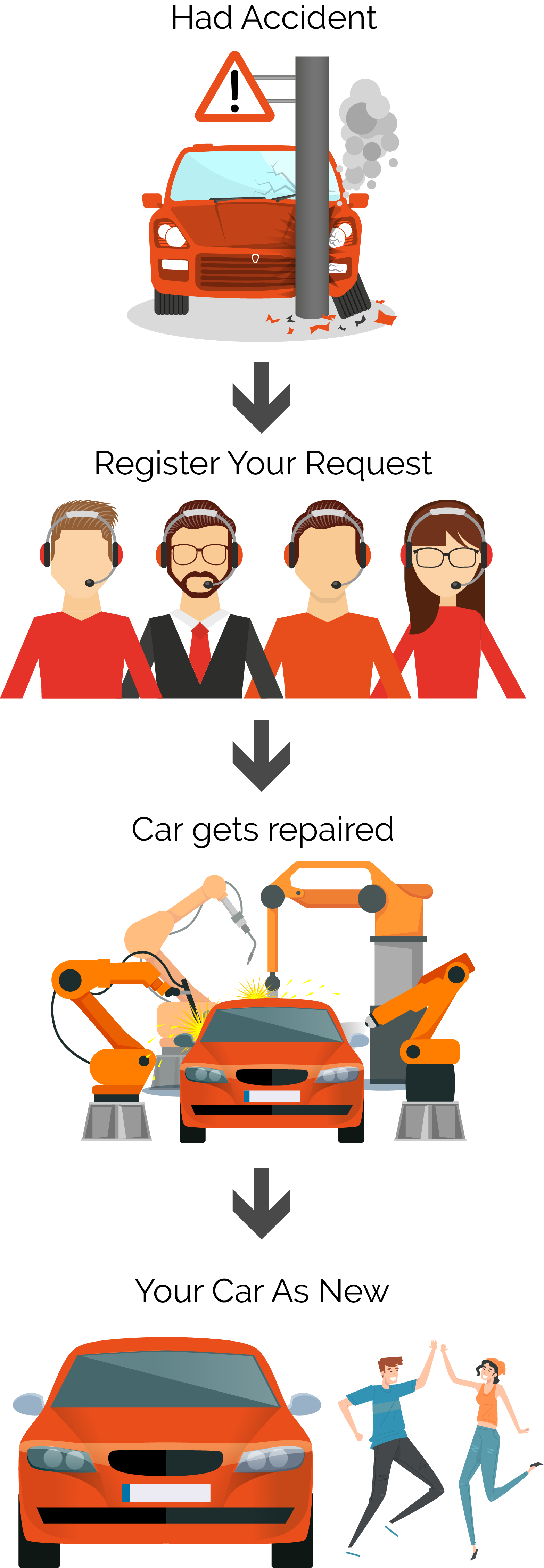

Motor Claim Process

Going through an accident would be a very traumatic experience. Just stay calm in such situation and follow these procedures to get your claim!

Health Claim Process

On A Cashless Basis

Cashless hospitalization is a facility provided by the Insurance Company wherein the policy holder can get admitted and undergo the required treatment without paying directly for the medical expenditure. The eligible medical expense, thus incurred, shall be settled by the Insurance Company directly with the hospital. The Cashless claim facility can be obtained only at the hospital listed in the network of the Insurance Company.

Inform Your Insurer

Hospitalization happen under two circumstances - planned and emergency's :-

- Planned: Once your doctor has recommended for the hospitalization,contact your insurer immediately and inform about the hospitalization.

- Emergency: In case of emergency hospitalization,you must inform your insurer within 24 hours of hospitalization.

Admit In Hospital

Get admitted to the hospital by showing your health ID card or policy number for identification purpose.Hospital will check your identity and fills up the Pre-Authorization Form with all the relevant details and send to the insurer.

Documents To Be Sent With Pre-Authorization Form

Ready with you the below documents to be sent along with the pre-authorization form:

- Policy Copy/ Health Card

- ID proof with address

- Investigation Test reports from Pathologis

- Medico Legal Certificate (MLO)- in accident cases

(Note: you may require to send additional documents depending on your insurer's requirement)

Confirmation Of Insurer To Proceed With Services

Hospital will submit the pre-authorization form to the insurer. Insurer will review the documents and provide confirmation to the hospital to proceed with the cashless services. Normally, TPA issues a letter of confirmation within 3-6 hours provided all relevant documents are submitted.

Hospital Sends Bill To Insurer During Discharge

Hospital sends the final bill to the insurer at the time of discharge.

Direct Payment

Once the bill is confirmed, insurer makes payment directly to the hospital.

Claims On Reimbursement Basis

In case of a reimbursement claim, the policy holder pays the expenses himself with the hospital and then claims for a reimbursement of those expenses from the Insurance Company by providing necessary documentation.

Inform Your Insurer

Hospitalization happen under two circumstances - planned and emergency's :-

- Planned: Once your doctor has recommended for the hospitalization,contact your insurer immediately and inform about the hospitalization.

- Emergency: In case of emergency hospitalization,you must inform your insurer within 24 hours of hospitalization.

Get The Treatment Done

Avail the treatment as prescribed. Intimate your insurer in case of the treatment done outside the network hospital. In the meantime, you can proceed with your treatment and pay the bill. Get your all original documents and reports from the hospital.

Submit The Documents To Your Insurer

Submit the following documents to your insurer:

- Complete and signed Claim form with attending doctor's prescription.

- First prescription of the present illness, for which treatment has been undergone in hospital/nursing home.

- Medical advice for hospitalization.

- Discharge summary of hospital.

- Final bill of the hospital.

- Medical fitness certificate.

- All test reports supported by medical prescription (pre & post hospitalization).

- All vouchers/bills/receipts pertaining to the tests mentioned above.

- All medicines purchased from outside the hospital at any point in time to be supported by original prescription.

(Note: you may require to send additional documents depending on your insurer's requirement)

Claim Documents Review By Insurer

Your insurer will review the claim documents received and effect the payment within 7 days of receiving documents. If treatment claimed is not covered under your plan, a rejection letter will be sent to you stating the reason for the same.

Hospital Sends Bill To Insurer During Discharge

Ready with your documents to be sent along with the pre-authorization form